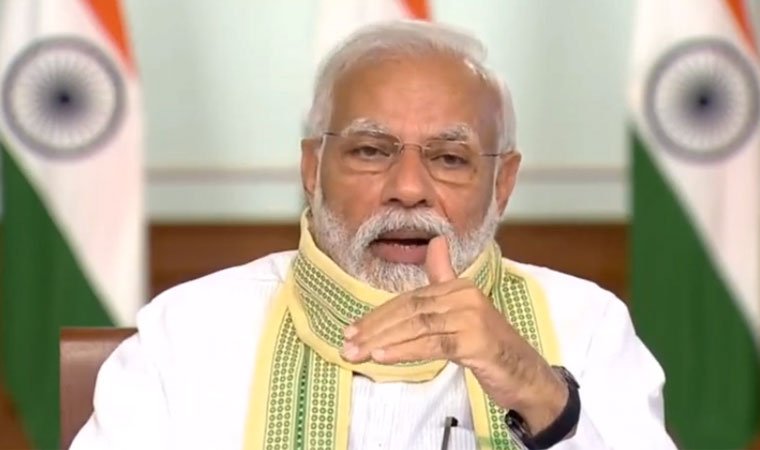

Prime Minister Narendra Modi welcomed the India–US agreement on a framework for an Interim Trade…

RBI to Implement New Banking Guidelines from January 1, 2025, Affecting Dormant, Inactive, and Zero-Balance Accounts

Starting January 1, 2025, the Reserve Bank of India (RBI) will introduce new regulations that could affect millions of bank accounts across the country. The changes aim to enhance banking security, transparency, and efficiency, while reducing fraud risks. Under the new guidelines, the RBI will close dormant accounts (no transactions for two years), inactive accounts (no activity for 12 months), and zero-balance accounts. Customers are urged to reactivate their accounts, update their KYC details, and meet minimum balance requirements to avoid account closures. These measures are part of the RBI’s efforts to modernise the banking system and improve account security.